Vietnam Rises to Runner-Up in the Global Cryptocurrency Adoption Race

In the context of the rapidly growing global digital finance landscape, cryptocurrencies are becoming a prominent trend and an integral part of many countries' financial strategies. The United Arab Emirates (UAE) and Vietnam are among the leaders in embracing and adopting cryptocurrencies, helping to shape the future of the global digital economy.

Vietnam – Runner-Up in the Cryptocurrency Adoption Race

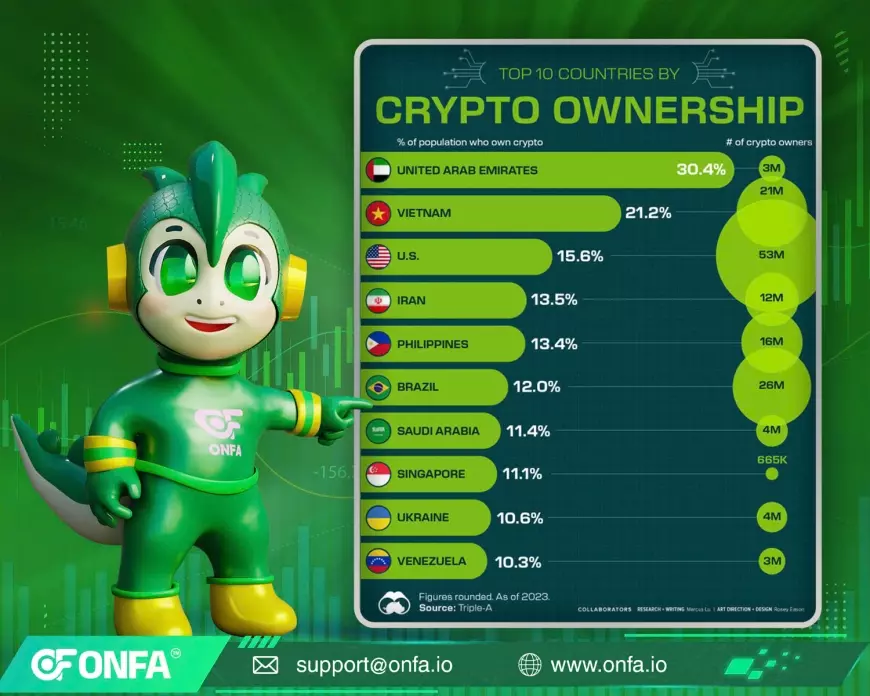

According to the latest data from Triple-A, the UAE leads globally with approximately 30.4% of its population, or around 3 million people, owning cryptocurrencies. Vietnam is not far behind, securing second place globally with 21.2% of its population, or roughly 21 million people, participating in the cryptocurrency market. This remarkable progress has propelled Vietnam to the runner-up position, surpassing even Singapore – a major financial hub with a complex financial environment.

The strong growth of cryptocurrencies in Vietnam reflects a broader trend in emerging markets, where digital assets are increasingly seen as a valuable investment option and an effective tool for portfolio diversification. Meanwhile, despite Singapore's robust financial infrastructure, the adoption rate of cryptocurrencies there is only 11.1%, indicating a more cautious approach to embracing digital assets.

Global Cryptocurrency Adoption Rates

In addition to the UAE and Vietnam, several other countries also report notable cryptocurrency adoption rates. In the United States, 15.6% of the population (equivalent to 53 million people) owns cryptocurrencies, thanks to key decisions such as the approval of spot BTC and ETH ETFs. Iran and the Philippines also show strong cryptocurrency adoption, with rates of 13.5% and 13.4%, respectively, highlighting the widespread appeal of digital assets as a financial tool.

Cryptocurrency Reform and Regulation: How Countries Are Adapting

As cryptocurrencies continue to gain widespread acceptance, countries are strengthening legal frameworks to regulate and monitor this sector. For example, the Monetary Authority of Singapore (MAS) has updated the Payment Services Act to expand regulations on the custody of digital payment tokens and cross-border transactions, with the aim of protecting consumers and ensuring financial stability.

In the United States, while BTC and ETH ETFs have been approved, lawmakers are still seeking cryptocurrency advocates to expand opportunities for the market in the near future.

What's Your Reaction?